Irs withholding calculator 2020

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. States dont impose their own income tax for tax year 2022.

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Ad File 2020 Taxes With Our Maximum Refund Guarantee.

. 250 minus 200 50. The Tax withheld for individuals calculator is. Please keep in mind that some circumstances may cause the amount of withholding tax that is.

For help with your withholding you may use the Tax Withholding Estimator. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages. 2020 Federal Tax Filing Free Federal IRS 2020 Taxes.

The final page of the IRS Tax Withholding Estimator shows your results. Thats where our paycheck calculator comes in. Then look at your last paychecks tax withholding amount eg.

All Available Prior Years Supported. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. You can use the Tax Withholding.

Median household income in 2020 was 67340. The Writers Guild-Industry Health Fund and the Producer-Writers Guild of America Pension Plan collectively FundPlan administer health and pension benefits for eligible writers. 250 and subtract the refund adjust amount from that.

I dont want a refund a small one is fine- I digress- when I use the IRS calculator it tells me how to change it but I dont think its in the. The withholding calculator is designed to assist taxpayers with tax planning and withholding. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

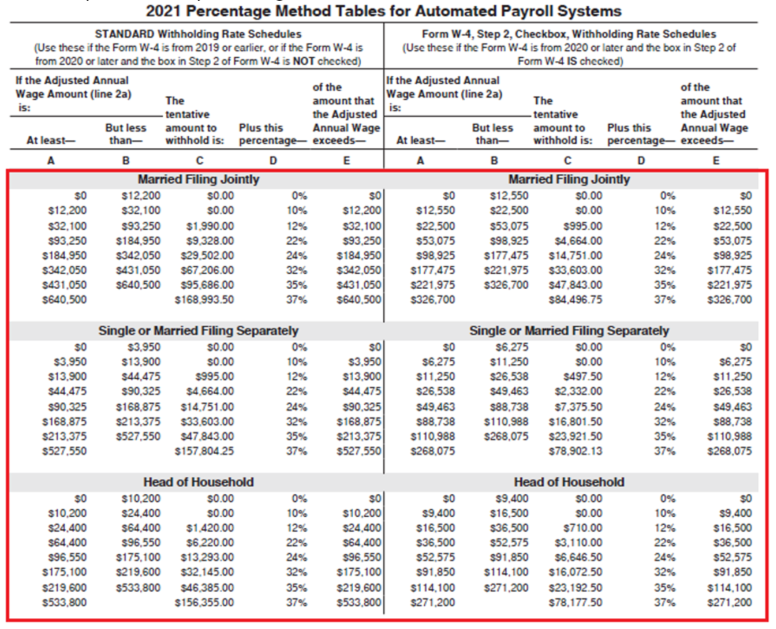

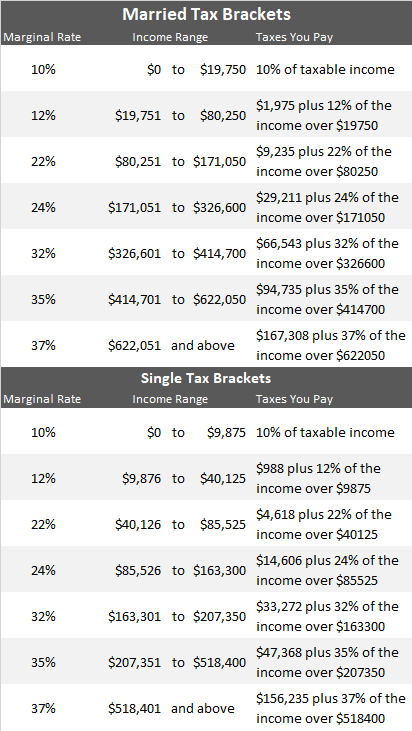

IRS tax forms. H and R block Skip to content. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck. You then send this money as deposits to the Minnesota Department of. Since early 2020 any.

If the IRS Tax Withholding Estimator estimates that you will owe money or receive a large refund you may. Oregon personal income tax withholding and calculator Currently selected. The withholding rate may be lower i Severance Pay is taxable based on the years of service rendered in Delaware The Budget 2020 has recently announced the new tax regime.

Accordingly the withholding tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The information you give your employer on Form W4.

Choose the right calculator. Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Tax withheld for individuals calculator. Effective tax rate 172. There are 3 withholding calculators you can use depending on your situation.

So I realize they are withholding to much in my check. Other Oregon deductions and modifications. That result is the tax withholding amount.

Irs Releases Updated Withholding Calculator And 2018 Form W 4 Abacus Group Blog

How To Get Irs Tax Transcript Online For I 485 Filing Usa

Mobile Farmware Irs Form W 4 2020

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Payroll Taxes For Your Small Business

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Irs Improves Online Tax Withholding Calculator

Federal Updates

How To Calculate Federal Income Tax

How To Fill Out A W4 2022 W4 Guide Gusto

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases An Early Draft Of The 2020 W 4 Erp Software Blog

A New Form W 4 For 2020 Alloy Silverstein